How To Trade Futures

- Real Vision

- January 12, 2022

- 2:20 PM

What is a futures contract?

A futures contract (short: futures) is a legal agreement to buy or sell a particular asset, commodity, or security at a predetermined price at a specified time in the future. Unlike forward contracts, futures contracts are standardized for quantity and quality of the underlying asset, which allows for efficient trading. Futures exchanges act as marketplaces for these types of instruments.

The buyer of a future contract assumes the responsibility to purchase and receive the agreed upon asset at the expiration date. The seller of the future contract is taking on the obligation to sell and deliver the underlying asset at the agreed upon price at the expiration date. The buyer of a futures contract is said to hold a long position or simply ‘be long’. The seller is known as to have a short position or simply ‘be short’.

Future contracts belong to the category of financial derivatives, just like options, swaps, forwards, warrants and similar financial instruments do. What all derivatives, despite their various designs, have in common is that their value is derived from and dependent on the price development of an underlying asset.

Investor tutorials (Video): How does the futures market work?

Pros & Cons of trading futures

In recent years, fuelled by the volatility of the financial markets, some market actors and politicians have expressed concerns about the overuse of financial derivatives (which includes futures) and their leverage effect on the financial system. The following list highlights some of the pros and cons of why futures are useful tools, but could potentially also be problematic for the single investor and the financial system as a whole.

Pros

- Futures provide manufacturers and producers with price and cash flow stability and cost control.

- Investors can use futures to hedge their existing positions against unfavorable price movements and crashes

- Investors can use futures to leverage their positions and speculate on the price development of the underlying asset.

Cons

- The amount of derivatives in circulation is so high, that it potentially poses a risk to the stability of the financial system.

- Due to the futures’ inherent leverage and the use of margin, investors with naked positions can end up incurring huge losses.

- Futures not only limit the downside, they also limit the upside. The price for stability and security is the inability to participate in favorable price movements.

If you’re looking for a reliable way to elevate your investing education, look no further. Now you can access The Real Investing Course — part of the Real Vision Academy — without committing to an annual membership… and at 40% discount.

With thousands of hours of expert insights distilled into one 10-hour workshop, the course gives you all the tools you’ll need to navigate markets no matter the environment — with lessons from trading legends like Peter Brandt, Lyn Alden, Mike Green, Raoul Pal, and many more.

How to Hedge with futures

One of the main reasons for the development of futures contracts was the need for price hedging. The textbook example hereof is a farmer who wants to safeguard against future price movements of his planted grain. He pre-sells his harvest at seed time for a predetermined price, thereby hedging himself against future price movements. The counterparty, e.g. a food manufacturer, wants to hedge itself against unfavorable price changes as well. Entering into a futures contract with the farmer allows them to secure a predefined purchasing price for ingredients needed in future production.

Of course, such hedging strategies with futures contracts not only work for physical goods such as grain or corn, but for most assets traded on financial markets. Stock, bond, interest rate, index, currency and commodity futures are the most common futures contracts on the market. The underlying principle is the same for all of these types: two parties agree upon a fixed price today for a transaction happening in the future.

Hedging with futures can be done using long hedging or short hedging strategies. Both strategies are widely used but serve different purposes and interests.

Long hedging (Longs): A long hedge is a future contract usually entered with the attempt to lock in a favorable price in advance of a transaction. Manufacturers and producers often enter these contracts with the purpose of price stability and to avoid price volatility, as it protects them from rising prices. It therefore may also be referred to as an input hedge, buy hedge or purchaser hedge.

A long hedge is often part of a cost control strategy for companies that know they will need to purchase a commodity in the future. Locking in a purchasing price ahead of time allows for more flexibility, production cost certainty and helps companies to offset the costs in case the hedged goods rise in price.

Short hedging (Shorts): A short hedge position is usually taken by the producers of goods and commodities or investors and traders who seek protection from falling prices. Companies use short hedges strategies to manage their future production and inventories. Entering a short position, which guarantees a minimum selling price for their goods, ensures a steady cash flow in times of high price volatility or unexpected events. Especially companies with high set-up and fixed costs are dependent on certain market price levels to be profitable. Futures contracts help such companies to maintain a basic level of profitability in the short to mid-term, even in hostile market conditions.

Hedges, both long and short, can be thought of as a form of insurance. There is a cost to enter futures contracts, but they can protect companies from large losses in adverse situations.

Watch the video: How delta & gamma hedging moves markets

How to trade with futures

As discussed, futures contracts originally have been created with the purpose of price hedging for producers and manufacturers of goods and commodities. But the success of these instruments hasn’t stopped there. Today, futures contracts allow investors to speculate on the price movements of commodities, securities, currencies or other financial instruments, either long or short, using leverage.

Trading futures requires a basic understanding about how futures contracts work. Technically, the buyer is obligated to buy the product at the agreed upon price at the time of expiration regardless of what the market price may be. But today, most traders never take physical delivery of the asset. Rather, traders win and lose money based on a contract’s price swings. Most traders opt to close their positions before the contract expires, never having been interested in physical delivery in the first place, but simply seeking monetary profits.

Further, when trading futures, it is vital to understand a futures price quote. At first glance, it looks similar to a security price quote, but it displays some important extra information.

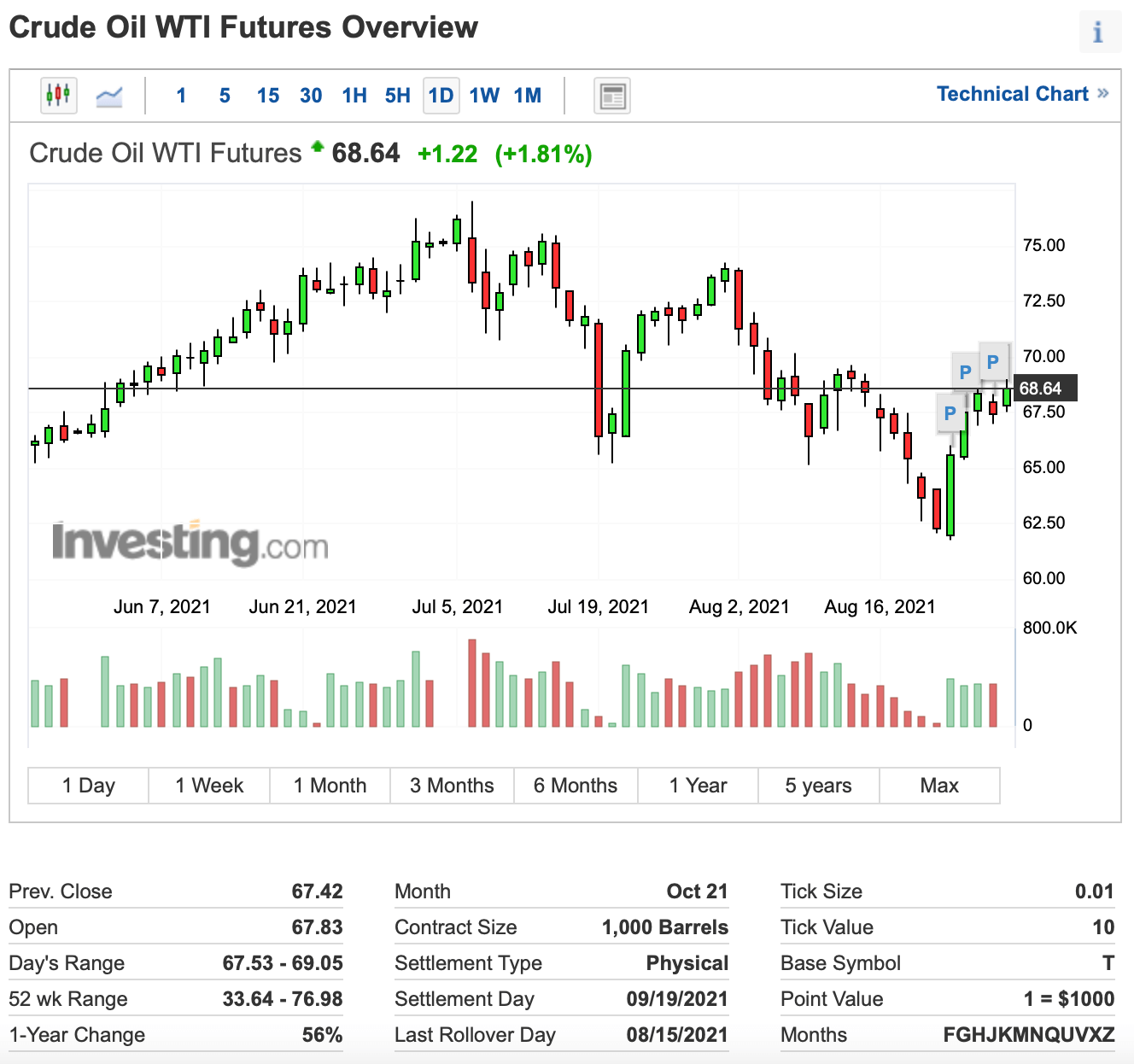

Expiration date: Every price quote displays the expiry month and year of the futures contract. Because these contracts are heavily standardized and have fixed expiration dates in the calendar (e.g. every third Friday of every third month), the expiration day is often not shown. The exact day is listed in the contract’s description which can be found with help of the contract’s unique ticker symbol.

Contract size: Contracts sizes are usually standardized bx echanges. Therefore a price quote often does not display how many barrels of oil or bushels of wheat are being delivered. Such information has to be looked up in the contract’s description. Contract size is important to keep an eye on, as the contract’s price moves according to the price movement of the underlying asset multiplied by the number of unit’s included in the contract. E.g.: if a trader owns a futures contract for a 1,000 barrels of oil, then a $1 price movement in the oil price equals $1 x 1,000 barrels = $1,000 price change in the futures contract. More on buying and selling oil futures here.

Open Interest: This is the number of outstanding or open contracts of the exact same type/ticker symbol. If this number sharply declines, it is very likely that the contract is close to its expiration date and traders are shifting their positions to other contracts.

Contract/Ticker: Each futures contract has a specific ticker symbol, which can be searched for. A search will lead to a contract’s detailed description, it’s exact expiry date and the contract size. This is important, as there are many different contracts for the same underlying asset traded on different exchanges with varying expiration dates and contract sizes.

Futures products

There are many different types of futures traded worldwide. Below, the most common types are shortly introduced.

Index Futures: Index futures are contracts through which a trader can purchase or sell a financial index today and have it settled at a future date. Traders use this instrument to speculate on the price movements of indexes such as the S&P 500 or the EURO STOXX. Further, index futures are also used by investors to hedge their equity positions against losses.

Commodity Futures: Commodity futures are used as a hedge against price increases in so-called long positions by manufacturers and traders who expect price increases for the underlying commodity. In the same way they are sold as a hedge against falling prices (short positions) by commodity producers and speculators, who predict price decreases in the future.

Interest Rate Futures: This future type has an interest paying instrument as the underlying asset. The contract is an agreement between a buyer and a seller for the future delivery of this interest-bearing asset. Interest rate futures allow parties to lock in the price of an interest-bearing asset for a future date, thereby providing a hedge or speculative instrument against changes in interest rates. Most interest rate futures that are traded on U.S. exchanges use U.S. Treasury bills as the underlying asset.

Bond Futures: This contract has a bond as the underlying asset and obligates the seller to deliver the bond for a predetermined price at the expiration date. Bond futures are used by speculators to bet on bond prices or by hedgers to protect bond holdings. Further, they can be used to indirectly speculate on or hedge interest rate moves.

Stock Futures: Stock futures are contracts to deliver a specified amount of a security for a predefined price at the agreed upon date. Like the other futures types, they can be used to hedge or speculate on stock price movements.

If you liked this article, then you will love Real Vision. Here at Real Vision, we help investors like you understand the complex world of finance, business and the global economy with real in-depth analysis from real experts. It’s in our nature to help you become a better investor, so sign up today to make it happen.